Why invest?

Investing, simply put, means putting your money to work. Instead of leaving it lying in a bank account, you purchase assets (property, term deposits, bonds, peer-to-peer lending, funds, or shares) so that the funds can grow in value over time. This can then be used to finance a property, used for retirement, or pay for that dream holiday.

Understanding Investment Options in New Zealand

New Zealand’s investment market offers a variety of options to suit your risk tolerance and goals.

Here are some of the popular choices…

- Shares: Owning a piece of a company and sharing in its profits (and losses). If the company does well, the share price goes up, and you can sell it for a profit. However, if the company struggles, the share price falls, and you could lose money if you sell.

- Bonds: Loaning money to governments or companies and earning interest in return. However, you could lose your money if the borrower cannot repay.

- Funds: A basket of different assets (shares, bonds) managed by professionals, offering diversification and convenience.

- Managed Funds (Active): These are actively managed by professionals aiming to outperform the market, but there is also a risk of underperforming.

- Managed Funds (Passive): These funds follow a market index, offering lower fees but mirroring market performance.

- Exchange Traded Funds (ETFs): Like passive managed funds, ETFs track a market index, but you can buy and sell them throughout the day on the stock exchange

- Cryptocurrency: Digital money not backed by a government. Its value can be highly volatile, which could skyrocket or plummet quickly.

- Precious Metals: Owning gold, silver, etc. Their value can fluctuate based on market demand, potentially going up or down.

- Property: Investing in residential or commercial buildings for rental income or capital gains.

- Peer-to-Peer Lending: Providing loans to individuals or businesses directly. You earn interest on the loan, but there is a risk the borrower might not repay.

- Traditional Assets: Low-risk options like savings accounts or term deposits that offer guaranteed returns, but typically low compared to inflation.

- Equity Crowdfunding: This option involves investing in startups or early-stage companies. There is a high potential for significant returns but also a high chance of losing your investment.

- KiwiSaver: A government-backed retirement scheme with compulsory contributions and a range of investment options, but funds are locked until retirement or upon purchasing your first home.

Why not just Save?

Saving means cutting back on your current spending habits and depositing the money into a bank account for any future plans you may have. These accounts attract little to no interest, and growth relies solely on the money you manage to save.

What are the Benefits of Investing?

While we do not discredit saving, investing has many positives, too; they are…

- Growing Wealth: Using the money you do not need to work for you means it has the chance to grow even further.

- Beat Inflation: Money placed into savings typically loses its buying power due to inflation. Investing allows you to keep ahead of this, especially if you plan to use funds much later on.

- Income Replacement: The cost of living is only increasing, and none of us plan to work until we die. A diversified, solid investment portfolio can eventually replace your income, providing a comfortable retirement or allowing individuals to cut back on work hours.

- Spreading Wealth: Most individuals have a substantial portion of their profit tied up in their house. This can pose a few issues, one being that a section of a home cannot be sold off for profit to cover expenses. It also means that money is focused on one asset instead of having a diversified portfolio. Investing allows you to spread your wealth across many assets, which can be managed to free up funds when you need them.

Finding Your Investment Sweet Spot

Choosing the right investment type depends on your risk appetite, timeframe (short-term vs. long-term goals), and financial situation.

Goals

First, ask yourself, “Why do I want to invest?” Do you want to build your portfolio to help fund the deposit for your first home within the next few years, pay for your child’s university or college fees in 15 years, or invest 15% of your income in staving off inflation in 15 to 20 years, or reach a particular figure for retirement in 35 years?

Risk and Reward

If you are after higher returns, you must understand that they come with higher risk. Consider how you plan to deal with losses and how comfortable you are with them.

Time

The timeframe of your investment goals plays a significant role in choosing the right investment type. Those with short-term goals may find lower-risk options like term deposits or savings accounts more suitable. On the other hand, growth-orientated investments like ETFs or shares are beneficial for long-term goals.

Investment Knowledge

Be honest about your investment knowledge. If you find certain investment options complex, they might require more research or professional guidance. Do not hesitate to seek help when needed.

Investment Essentials FAQ

Q. Who Can Invest?

Anyone with even a tiny amount of disposable income and a willingness to learn can begin investing. It is never too late to start, irrespective of your current financial situation or age. If you hold high-interest debts such as a car, personal loans, or a credit card, it is wise to have them paid off before you start your investment journey. The same can be said for having a portion of money saved for any emergencies. This will stop you from dipping into your current funds or taking from the cash you wish to use for investing.

Q. What are the Risks Involved?

All investments carry a certain degree of risk. Investors can mitigate this with portfolio diversification, which spreads risk across multiple assets. Remember that low-risk investments generally yield low returns, while high-risk investments deliver high returns.

Making money requires a level of risk, but risk can also be associated with volatility rather than losing all your funds. Volatile investments experience highs and lows over time.

Do not panic, though. Did you know that saving can be considered riskier than investing because inflation eats away at it and with no growth?

Q. Why Don’t International and New Zealand Share Prices Always Move Together?

International and domestic markets can be affected by global economic trends and the unique economic cycles of different countries related to government policies, interest rates and inflation rates. Natural disasters, elections, and trade disputes can lead to divergent markets. Also, the foundation of the stock market varies due to countries relying on specific commodities versus those that are tech-driven. Lastly, investor confidence and risk appetite have a knock-on effect on share prices.

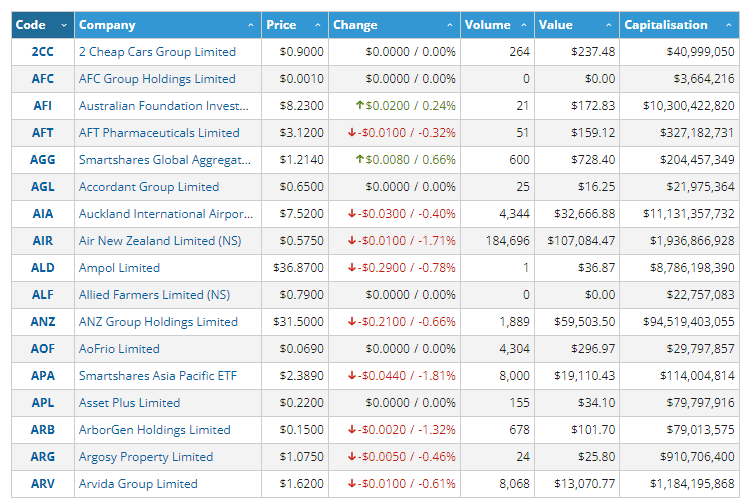

Q. Where can I Find shares in New Zealand’s Biggest Companies?

You can find shares in the largest and most well-recognised companies via the NZX Main Board (NZSX), our primary stock exchange in New Zealand. This serves as a marketplace for investors looking to buy and sell shares related to these companies.

Q. How much money do I need to start investing?

The amount you need will vary depending on the investment options you choose. However, there are many platforms where you can start your investment journey for even a few dollars a week.

Q. What are the tax implications of investing in New Zealand?

Different types of investments will have differing tax implications, and it’s important to understand the tax rules that apply to your specific investments. Consider consulting with a tax advisor to help you minimise your tax liability.

Q. What are some popular investment options for beginners in New Zealand?

- KiwiSaver: This is the easiest way to get started investing as the money is taken directly from your paycheck before it gets to your checking account. Both the government and your employer also contribute, maximising the percentage you are investing. However, this money can’t be withdrawn until you retire.

- Managed Funds: These are professionally managed portfolios of investments, allowing you to diversify your investments and reduce risk.

- Exchange Traded Funds (ETFs): ETFs are similar to managed funds but trade on the stock exchange, offering a more cost-effective way to begin investing in a diversified portfolio.

- Shares: Investing directly in shares of individual companies can offer higher potential returns but also higher risk.

- Property: Investing in property can provide both income and capital growth, but it requires significant capital and careful management.

Q. How do I know which investment strategy suits me?

Your investment strategy should align with your financial goals, risk tolerance and timeframe. For example, conservative investors may prefer bonds or managed funds, while risk-tolerant individuals might prefer shares or property.

Q. Are managed funds or ETFs better for beginners?

Both are great options for beginners. Managed funds offer professional management, while ETFs provide lower fees and easy diversification. The choice depends on your preference for your level of hands-on involvement and the type of fee structure.

Q. How often should I review my investments?

You should review your investments at least once a year or whenever there are significant changes in your financial situation, market conditions, or investment goals. Avoid checking too often to prevent making emotional decisions about your investments.

Q. What fees should I expect when investing in New Zealand?

Investment fees can include platform fees, management fees, and transaction costs. Always check the fee structure of your chosen investment platform or fund, as high fees can eat away at your returns over time.

A Long-Term Commitment, not a Gamble

Investing is not a get-rich-quick scheme and is a long-term strategy that requires discipline and patience. Successful investors understand that it takes time (several years) to see significant returns. It is also important not to confuse investing with trading. Trading involves buying stocks with the intention of selling them quickly to make a profit. Lastly, investing is not gambling but rather making careful decisions on where to put your money to achieve long-term wealth growth.

Strategies for Choosing the Right Assets

Irrespective of what you would like to invest in, here are a few strategies to consider when building an investment portfolio in New Zealand.

- Asset Diversification: Diversification is a fantastic way to manage investment risks. If an asset goes under, you will not succumb to losing all your funds. It also leaves room for a well-performing asset to counterbalance those underperforming assets.

- Geographical Diversification: Do not think that you cannot invest offshore because you live in a particular country. Look into international shares (USA, UK, Australia) that provide exposure to various economies and potential growth opportunities.

- Sector Diversification: Agriculture and tourism are key sectors that New Zealand is heavily reliant on. Spruce up your portfolio by including different sections to avoid overexposure to any one specific area.

- Company Diversification: Relying on one successful business, even two, is risky. Consider spreading your shares among a selection of companies and industries. This will mitigate the impact if one company performs poorly.

Which Service Providers Can I Use to Help Me Invest?

When you have settled upon the assets you want to invest in, the next point of call is to select the service provider to get your investment journey underway. New Zealand has many providers, and new investors in the market can find the process of selecting the right one challenging.

However, the choice becomes more manageable when you settle upon the types of assets you want to invest in and how you would like to diversify your portfolio. This is because service providers are unique and provide distinct kinds of assets.

For example…

- Sharesies: Known for its user-friendly interface and fractional share investing, making it easy to start with any amount.

- Hatch: Offers a wide range of global shares and ETFs at competitive fees, appealing to investors seeking international exposure.

- Kernel: Specialises in low-cost index funds, a good option for those who want a simple, low-fee, long-term investment.

- Tiger Brokers: Caters to active traders with its advanced features and low trading commissions. It is ideal for experienced investors who are comfortable with a higher level of involvement.

- InvestNow: Provides access to a vast selection of managed funds from various New Zealand fund managers, allowing investors to choose funds that align with their specific goals.

Banks

Some banks offer investment products equivalent to managed funds and term deposits. They could be a good option when you are looking to start investing. However, their investment options may be limited.

Major New Zealand banks include…

Fund Managers

They manage portfolios and actively engage in research and analysis to make investment decisions that align with specific goals. This is recommended, especially when investors do not have time to do the research themselves or lack the required skills. However, fund manager fees can eat into your returns.

Active fund managers…

Passive fund managers…

Fund Platforms

These web platforms provide an effortless way to access a wide range of managed funds, shares, and ETFs (exchange-traded funds). They offer the advantage of flexibility compared to a traditional broker, but you must research and make your own decisions before making any investments.

For example…

Brokers

Brokers allow you to buy and sell individual shares of stock on the stock exchange. This gives you the most control over your investments, which also requires the most research and knowledge. Brokers can be a good option for experienced investors.

For example…

Alternative Investment Platforms

Do you wish to go beyond traditional types? Platforms like these provide access to alternative assets you can invest in, from peer-to-peer lending to property crowdfunding. While they can be profitable, they present significant risks. Thorough research into these opportunities is needed, primarily due to the elevated risk involved.

For example…

Financial Advisers

Financial advisers provide personalised advice based on your specific needs. They can help you to create a well-defined investment strategy, select attractive investments, and manage your funds over time. However, their services generally come with fees.

Find an adviser by visiting Financial Advice New Zealand.

How to Choose an Investment Partner

The choice of who to help support your investment journey will depend on how comfortable you are with managing your own investments, goals, and experience level.

Top tips…

- Consider the fees each provider charges. This could be their account, transaction, and management fees.

- Look into the variety of investment options they provide. Do they offer the types of investments you are interested in? Would there be an opportunity to diversify across many assets?

- Some suppliers require a minimum investment; check what this will be.

- Depending on your comfort level with investing, the support you receive will significantly influence the smoothness of your investment journey. It is important to understand the level of service and support you will receive from a provider. Will they be there to guide you and help you make the right decisions?

Ready to Invest Smarter?

Remember, investing takes time, and success happens over the long term. Be patient, do your research, and adapt your investment strategies to your goals and circumstances as they arise. With the right portfolio and the right service provider by your side, you will comfortably accomplish your financial objectives.

Looking for an alternative investment with competitive returns? Look no further than MoneyShop! We can be your partner on your investment journey.

Contact us today to learn more!